Burlington Good Stock to Buy. Value investors look for companies that have not yet captured the attention of many investors. This gives them an opportunity to buy a company at a discount. This means that the stock will be less sensitive to news that may affect the public’s sentiment.

Value investors also consider a company’s margin of safety to determine if it’s undervalued at its current share price levels. Margin of safety is the difference between the current share price and a value.

Another way to determine whether it undervalued a company is to look at its business model. If a traditional retail store is struggling to compete with online retailers, it’s likely that its stock price will remain in a downward trend until it transitions to a new model. While many retail businesses are struggling to keep up with the competition, some can innovate by shifting into ecommerce or differentiate themselves in other ways.

Burlington Stores analyst

When making investment decisions, it is crucial to choose the right benchmarks. Many naïve investors compare their positions to the S&P 500 or the Nasdaq, but these indexes are not all-inclusive and only measure the performance of large companies. Burlington Store’s stock price consensus is based on the average price forecasts from analysts who cover the company.

When evaluating an investment, it is crucial to calculate the probability of extreme price movements. An accurate representation of Burlington Stores’ historical returns can help investors understand the risk-reward tradeoff.

Past price action

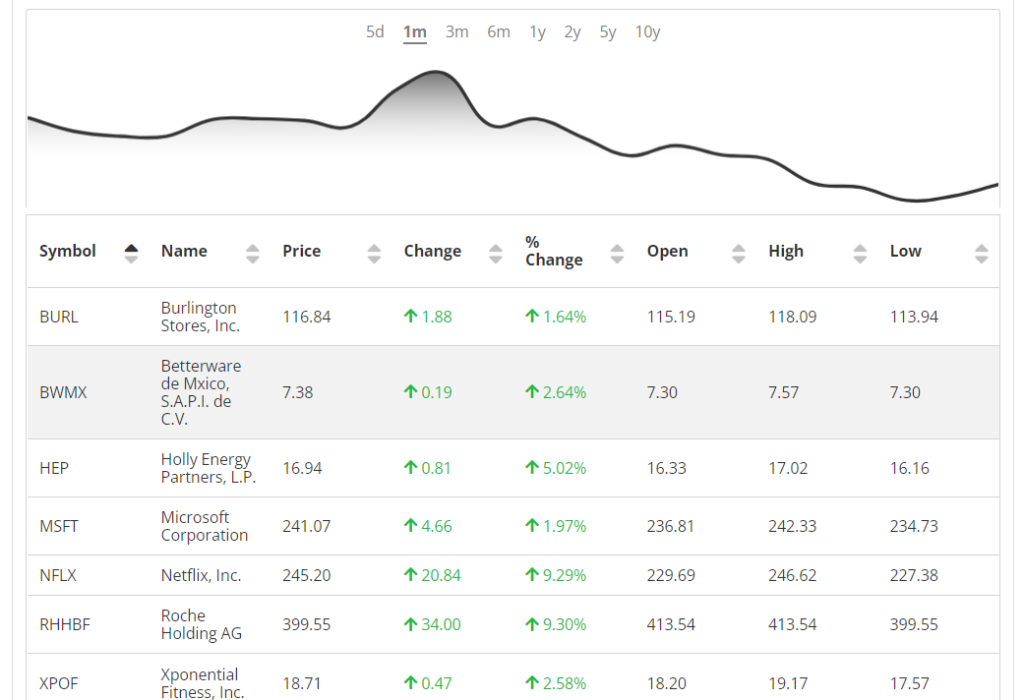

The past price action of Burlington stock is an important tool to use in trading. Several factors can affect the price movement of a stock, including the company’s earnings history and its volatility. After the company released its Q3 earnings results, shares of Burlington Stores (NYSE: BURL) experienced some volatility. They fell over 5% in pre-market action but rallied over 8.0% by the close of the session. Burlington Stores have increased its prices in recent years, which has allowed the company to gain share from its competitors.

Besides the stock’s past price action, analysts also look at the company’s future prospects and earnings. If the company is profitable and has growth prospects, then its valuation will increase. Similarly, if the company’s product lines expact to expand in the future, then its valuation will increase. This is how financial analysts value a company, and the past price action of Burlington Stores can help you make informed investment decisions.

Short-term moving averages

There are several ways to use short-term moving averages to analyze a company’s stock price. You can use them to identify trends and price levels, as well as to predict future price movements. These indicators can help you determine whether a stock is a good buy or a bad one.

The P/E ratio is one way to look at a company’s profitability. It gives you a broader view of a company’s profitability and growth.

The short-term moving averages of BURL are showing a bullish divergence in June and August. This divergence is a sign that the pace of decline has slowed in the near-term. However, this divergence is too small to make a significant difference in a short-term trading scenario.

Probability of bankruptcy

The Probability of Bankruptcy for Burlington stock measures the company’s likelihood of experiencing financial distress within the next two years. It drive from a multi-factor model developed by Macroaxis and is based on the company’s balance sheet, cash flow statement, income statement, and other financial information.

Read More: Your Goals As A Foreign Exchange Market Trader

The Altman Z-score is a tool to determine a company’s risk and a high Altman Z-score shows a high probability of bankruptcy. Altman based his calculations on the belief that the crisis would be primarily because of the default of mortgage-backed securities. In fact, a collapse of these securities caused the 2008 financial crisis, and corporations defaulted at the second-highest rate in history.