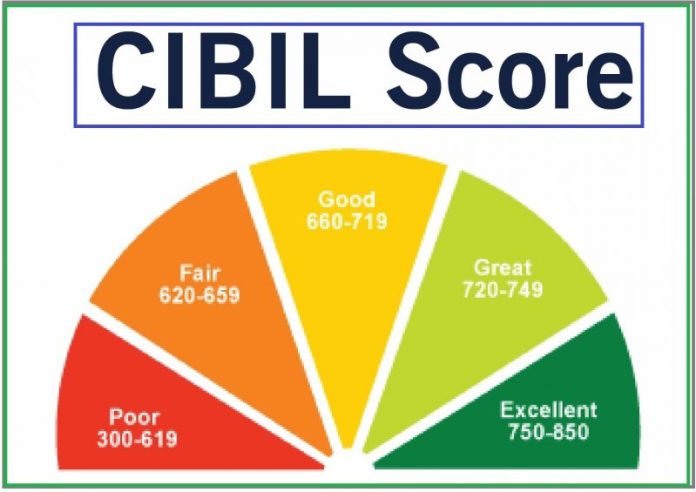

Did you know? CIBIL score is needed for Personal Loan. CIBIL score is one of the major factors that impact while you are applying for a Personal Loan. Credit rating agencies are responsible for managing and generating credit scores for customers from all over the world. CIBIL score is a three-digit score that represents the credit history of an individual. The three-digit is derived from the past credit history and present credit activities. CIBIL score ranges from 300- 900. An individual with a CIBIL score of more than 750 is considered creditworthy as compared to an individual with a lower CIBIL score.

Here are a few interesting facts about the CIBIL score and how to maintain it:

- Your CIBIL score is indifferent from the score from other agencies

There are various credit bureaus in India like CIBIL, CRIF High Mark, Equifax, and Experian that provide the credit information of the individual. These credit bureaus use their models for scoring and measuring the individual’s credit score. The credit information provided by these credit bureaus will be similar however, there may or may not be a difference in the credit score. Usually, the updated credit information from different bureaus gets reported on a different day.

- Checking your CIBIL score frequently hurt your CIBIL score

When an individual checks their CIBIL score directly or from an authorised third party, such inquiry is categorised as a soft inquiry. It doesn’t require any consent from the individual. For example, pre-approved credit cards. On the other hand, when you apply for a loan, a lender asks for a credit report to check the creditworthiness of the borrower. In such cases, an inquiry for a lender is considered a hard inquiry and it impacts your credit report. A frequent hard inquiry hurts your credit report.

- CIBIL Score and Credit Ranking are not similar terms

There is a lot of confusion among individuals regarding the terms of CIBIL Score and Credit ranking, especially among first-time borrowers. CIBIL score ranges from 300-900 and represents the creditworthiness of an individual. On the other hand, credit ranking ranges from 1 to 10 and is used for checking the creditworthiness of a company.

- CIBIL score has no relation to your saving and investment information

Your CIBIL score will be based on your past and present credit history and activities. Similarly, your credit report reflects past and present credit history and activities. There is no record of your savings and investments in the credit report.

- CIBIL is not responsible for any edit or removal of information

Banks and other lending institutions such as NBFCs are credible sources of the credit information and activities of individuals. CIBIL uses the mentioned sources to generate credit reports and credit scores. CIBIL is only responsible for generating the credit report and has no direct authority to edit or delete any information. In case, you want to find any errors in the credit report, you can contact the authorities to rectify the credit report.

Along with the above-mentioned facts, here are a few other facts that you must know:

- Applying for multiple credits can lower your CIBIL score

- An individual with a lower CIBIL score will get a loan but at a higher interest rate

- Multiple loans and credit cards negatively impact your CIBIL score

- Your CIBIL still exists even if you don’t request the same

How to maintain CIBIL Score?

As aforementioned, your CIBIL score represents your creditworthiness. Hence, maintain an individual needs to maintain a good CIBIL score to avail of a high amount loan at a lower interest rate. Below are a few of the things that you should keep in mind to maintain a good CIBIL score:

Also Read: Tips to Obtain an Easy Business Loan in India

- You should avoid any defaults or delays in repayment

- You should check your CIBIL score or credit score regularly or at least twice a year

- You should maintain your credit utilisation ratio

- You should have a balanced credit mix

- You should avoid multiple inquiries as it negatively impacts your CIBIL score

- You should avoid using the maximum credit limit

- You should avoid closing your old credit cards as they are a part of your credit history

The above-mentioned points will help you in maintaining your CIBIL score without any hassle. Furthermore, you should act responsibly while using your credit cards and loan as it can lead you into a debt trap. As mentioned above, a CIBIL score is needed for Personal Loan, so please ensure to check your CIBIL score before applying for a Personal Loan.