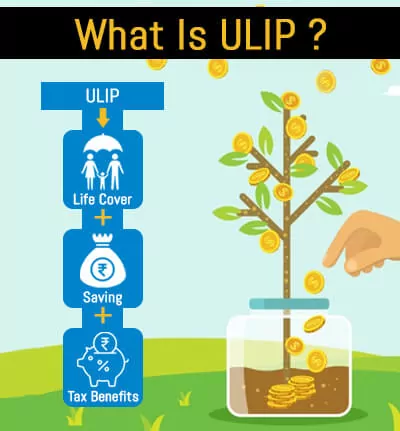

Having proper insurance in place and investing in equities are the two key pillars of wealth management. Investing in a Unit linked insurance plan, also known as ULIP, would be one of the best ways to enjoy a mix of both of these aspects of financial planning. It is also considered to be an excellent tax-saving instrument, but before getting into that, you should properly understand what a ULIP plan is.

ULIP: A brief overview

ULIPs are a mix of investment and life insurance coverage. These plans are meant to support wealth creation alongside providing life cover. As you buy a ULIP, the insurance company shall put a part of your investment towards life insurance, and the rest of the money will go into a fund based on equity, debt, or both, depending on your long-term financial goals. These goals can be funding kids’ education or their marriage, planning for higher education, and so on.

ULIPs also allow you to switch your portfolio between equity and debt on the basis of market trends and your risk appetite. This flexibility of switching makes ULIPs a highly popular investment option. Unit-linked insurance plans also allow you to make partial withdrawals after the completion of the 5-year lock-in period.

Tax Benefits of ULIPs

By investing in a ULIP plan, you would be able to enjoy tax benefits in multiple ways. Here are the four types of benefits that underline why ULIP is a good tax-saving investment: –

- Tax Deductions: You would have to pay premiums to the chosen insurance company as you purchase a ULIP. Such premiums would be deductible from your taxable income up to a limit of ₹1.5 lakhs as per Section 80C of the Income Tax Act, 1961, subject to provisions stated therein.

- Earnings benefits: As your investments grow over time during the policy tenure, they shall not be taxable as long as the money stays invested. This implies that you need not pay tax on the gains or earnings of the ULIP until they are realized.

- Switching benefits: ULIPs offer the advantage of switching the funds you have invested in during the policy period. Such switches will not be taxable.

- Exit benefits: In case of your demise during the policy period, the death benefits paid to your family would be tax-free. Maturity benefits, on the other hand, would be paid to you if you survive the policy period.

These maturity benefits will be exempt from tax subject to the clauses mentioned in Section 10(10D) of the Income Tax Act, 1961, for ULIPs that have been issued prior to 1st February 2021. On the other hand, for ULIP plans issued on or after 1st February 2021, the Long Term Capital Gains Tax (LTCG) shall be tax-free up to ₹ 1 Lakh for the relevant financial year. The LTGC gains beyond the exempted limitations shall additionally be taxed at 10% for all equity-oriented ULIPs. On the other hand, capital gains tax shall be applicable on the income from the policy at applicable rates for debt-oriented ULIPs.

If you hold multiple ULIPs that have been issued after 1st February 2021, you will have the option to select plans having premiums less than ₹ 2.5 Lakh in aggregate to be considered tax-free, subject to the Section 10(10D) of the Income Tax Act, 1961’s provisions. Just the incremental policy exceeding the premium sum of ₹ 2.5 Lakh shall be considered taxable.

Now that you know what is a ULIP plan and the tax-saving benefits it has, you will be able to understand better how and why such an investment option can prove advantageous for you. If you have certain long-term goals, like buying a car or a house, funding the marriage or education of your children, and so on, investing in a ULIP can be a smart way to get your money compounded.

The key objective of ULIPs is to enable wealth creation on your investment with the assistance of market-linked instruments and returns. Moreover, it provides a financial safety net that your family can fall back on in case of your demise during the policy tenure. ULIPs are highly flexible and offer a range of fund options to make your choice from, depending on your specific financial goals.

Note: The reader is requested to examine the authenticity and correctness of the article’s facts, legislation, and content with the applicable tax laws as of date and get suitable guidance from the financial advisors.